what is the tax abatement

Co-op and condo boards and managing agents must notify the Department of Finance of changes in ownership or eligibility for the Cooperative and Condominium Property Tax Abatement by. An abatement can last for.

Office Of The City Controller Releases Ten Year Tax Abatement Policy Analysis Office Of The Controller

This may be in a piece of commercial or.

. Examples of an abatement include a tax decrease a reduction in penalties or a. NRS 3614723 provides a partial abatement of taxes by applying a 3 cap on the tax bill of the. New Jersey authorized its municipalities to provide homeowners and property developers a 5-year tax abatement through the NJSA.

Typically property tax abatement is offered by a local government such as at a state or municipal level as an incentive for property owners. The 5-year tax abatement program. These incentives provide considerable savings for individuals and companies.

Property tax abatement is a decrease in the amount of money owed to a governmental tax authority on a real property tax bill. Abatements reduce the taxes after they have been calculated and. A property tax abatement is when there is a tax reduction on the tax obligation a person or company must pay in purchasing or owning property.

By reducing or eliminating. Best solution Property tax abatements exemptions and reductions are subsidies that lower the cost of owning real and personal. Abatement is a reduction in the level of taxation faced by an individual or company.

Tax Abatement is a property tax incentive that entities issue to significantly reduce or eliminate taxes that an owner pays. A tax abatement is a financial benefit that may reduce the amount of property tax you have to pay in NYC. It is offered by.

Tax abatements are programs where the government provides incentives that reduce or eliminate property taxes on specific areas for real estate. Abatements can also correct for over taxation and an individual or corporation can request an abatement to lower a property tax bill if they believe the property is. The tax abatement is an incentive to encourage people to redevelop and move into these areas.

What Are Tax Abatements. A tax abatement is a financial incentive that eliminates or significantly reduces the amount of taxes that an owner pays on a piece of residential or commercial property. Under Philadelphias long-standing residential tax abatement program residential property owners may qualify for a 10-year tax abatement.

The Nevada State Legislature has passed a law to provide property tax relief to all citizens. What is 10 year tax abatement. Tax abatements can be granted by any local government that collects ad valorem or value-based property tax however abatements can be granted only for property within a.

Whether revitalization efforts will ultimately prove successful is a big question. Payments increase steadily until the end of the 30 year term when payments could reach a high of 4781738 based on 80 percent of the current conventional tax rate. In most jurisdictions there are multiple.

A tax abatement is a government incentive that can lower or cut property taxes in a certain area. For example the government.

Property Tax Abatements How Do They Work

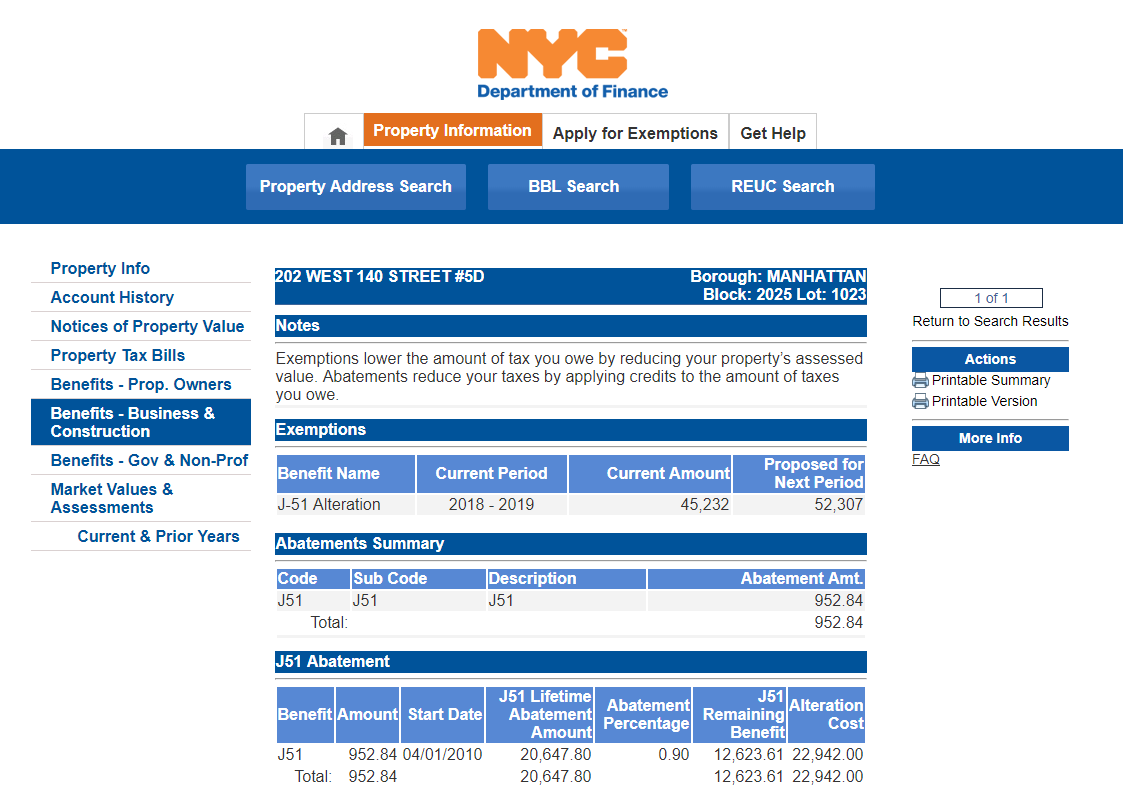

Buying An Apartment With A J 51 Tax Abatement Hauseit

Property Tax Abatements How Do They Work

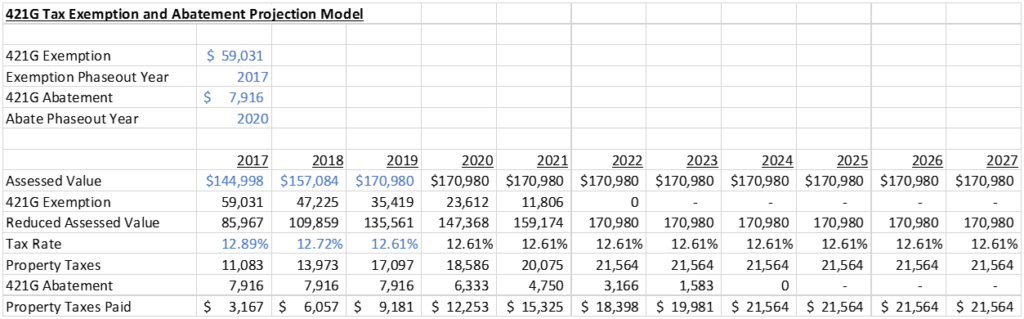

What Is The 421g Tax Abatement In Nyc Hauseit

Ten Year Tax Abatement Philly Power Research

What Are The Tax Abatements For Coops And Condos In Nyc Propertynest

Tax Abatement How Does It Help You Save On Property Taxes Mybanktracker

Schaeffer Family Homes Announces Tax Abatement

Unpacking The Real Estate Tax Abatement Debate The Temple 10 Q

What Is A Tax Abatement Smartasset

Cooperative And Condominium Tax Abatement Nestapple

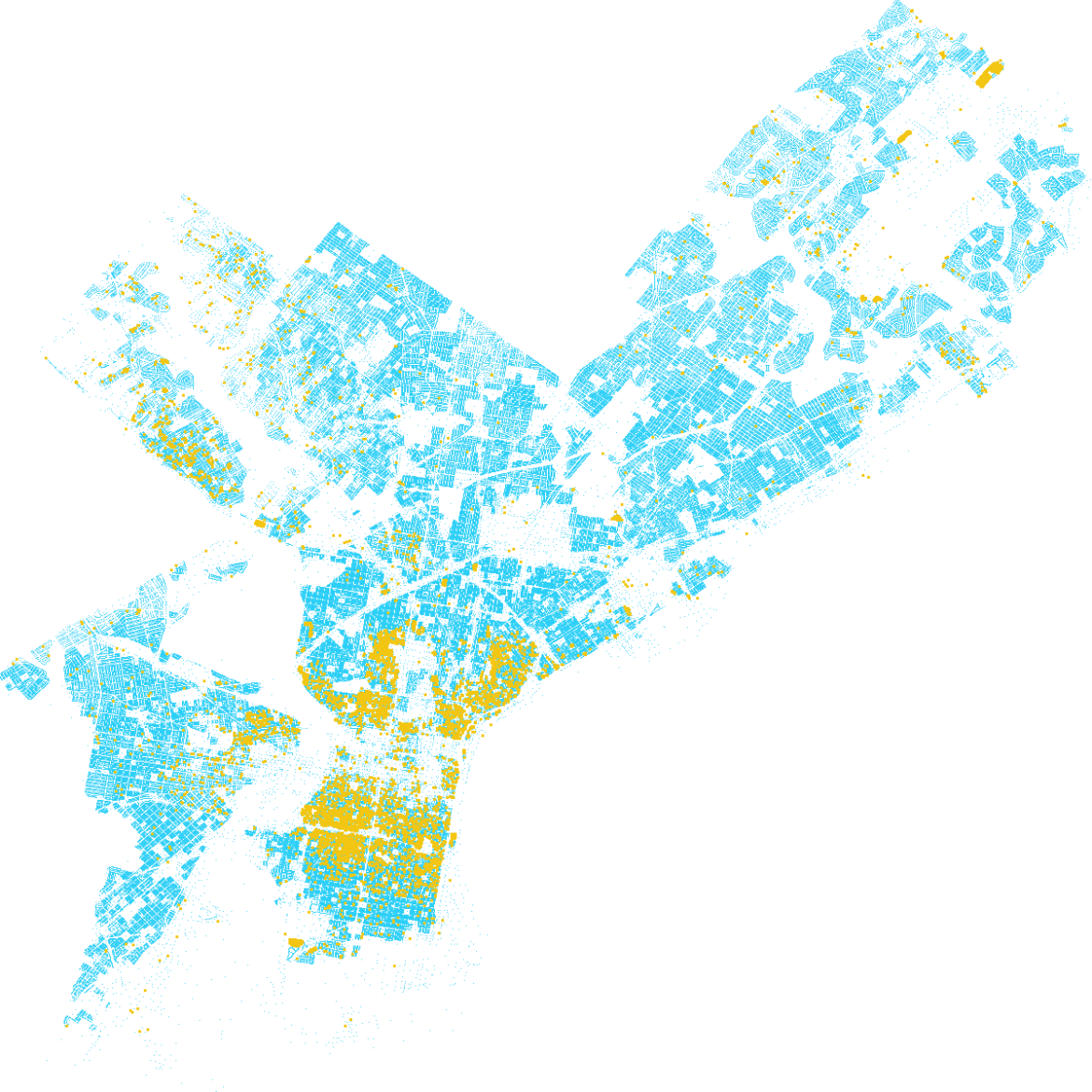

421 A Tax Break Will Continue To Cost Nyc Revenue For Decades After It Expires Report Finds 6sqft

How To Apply For Property Tax Abatements

![]()

District Of Columbia Tax Abatement Program Lexicon Title

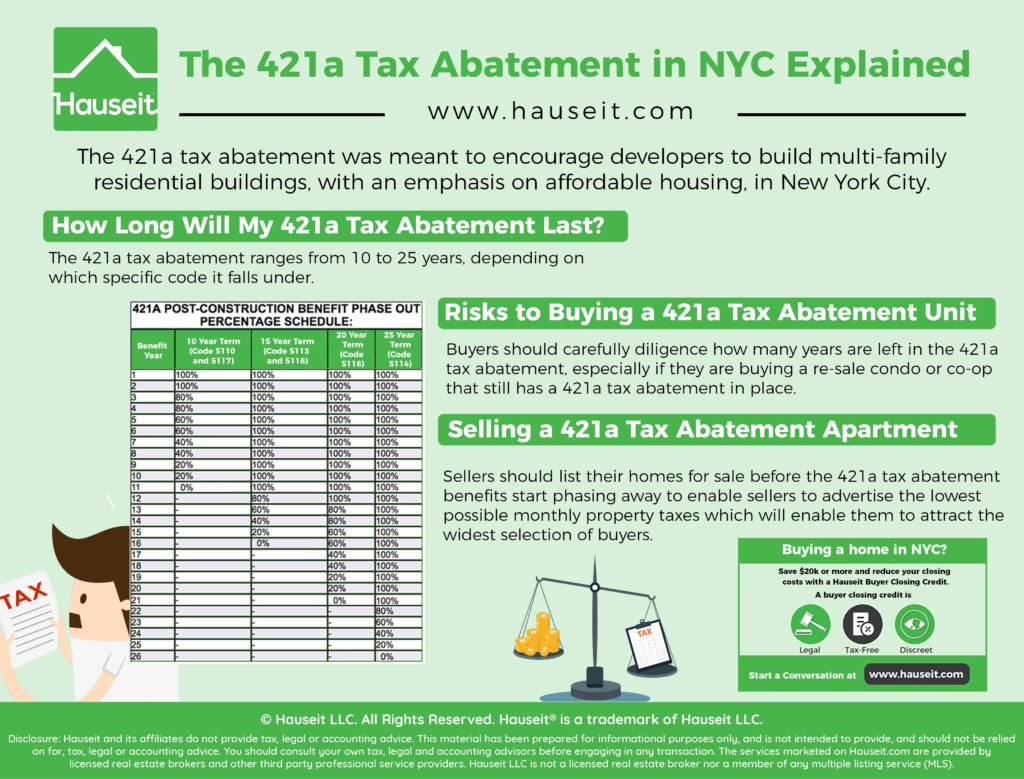

The 421a Tax Abatement In Nyc Explained Hauseit

Dc Property Tax Abatement Program No Tax For 5 Years Greenline Real Estate